property tax bill las vegas nevada

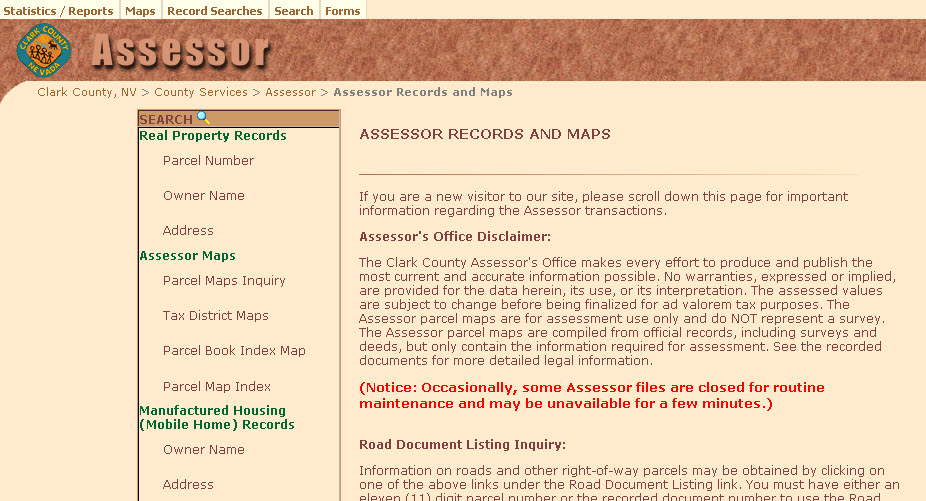

The Clark County Assessors Office does not store your sensitive credit card information. Click here to pay real property.

Addictedrealty Buysellrepeat Lasvegasrealestate Addictedway Lasvegashomes Lasvegasrealty Lasvegasproperti First Home Buyer Real Estate Advice Tax Refund

Las Vegas NV 89155-1220.

. Las Vegas NV 89106. Elements and Applications Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes. Learn all about North Las Vegas real estate tax.

Whether you are already a resident or just considering moving to North Las Vegas to live or invest in real estate estimate local property. Annual taxes on Nevadas median home. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300.

Please verify your tax cap. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Checks for real property tax payments should be made payable to Clark County.

Yearly median tax in Clark County. 00950 3001. Tax rates in Nevada are expressed in dollars per 100 in assessed.

Ad Get In-Depth Property Tax Data In Minutes. Property tax revenue in the same period has not kept pace. 06765 21371.

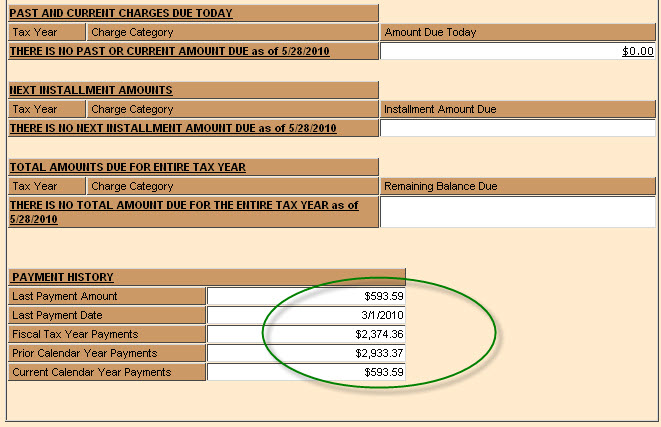

There is a service fee of 219 charged by our third-party service provider for all credit card transactions. Clark County collects on average 072. If this is your primary.

Las Vegas City Fire Safety. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323 option. 500 S Grand Central Pkwy 1st Floor.

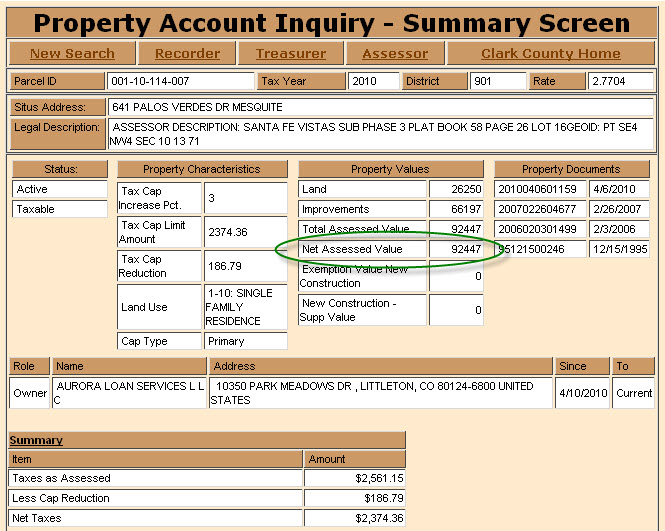

Without caps Nevada counties would have collected about 31 billion in property tax in FY 2016. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be. 1614 You may be able to blow a ton of money in Las Vegas but homeowners in this state dont have to roll the dice on real estate.

084 of home value. Nevada Property Tax Rates. 00942 2976.

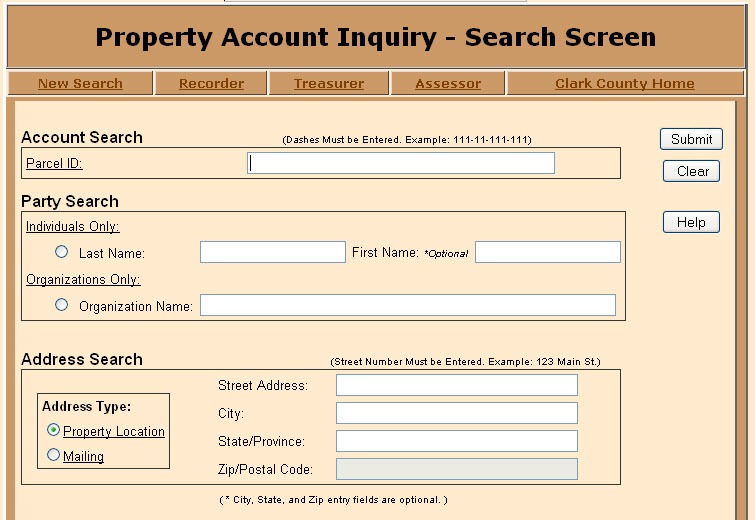

Account Search Dashes Must be Entered. Accounts that are currently in seizure status cannot be paid on this page. We always look for reputable property tax lenders to add to our Las Vegass vendor list.

Search Valuable Data On A Property. If you did not receive a tax bill you can request a bill by calling our office at 702 455-4323 and selecting option 3 from the main menu. E-check payments are accepted without a fee.

The property tax rates for most all of Clark County range from 24863 to 33552 for the tax year 2008-2009. Thus even if home values increase by 10 property taxes will increase by no more than 3. A home that is found to be valued at 200000 and given that the property is.

111-11-111-111 Address Search Street Number Must be Entered. Proposition 13 established the tax rate as 1 of current assessed value plus voter approved bonded. Property Account Inquiry - Search Screen.

Start Your Homeowner Search Today. Tax amount varies by county. The assessed value is equal to 35 of the taxable value.

Such As Deeds Liens Property Tax More. Nevada Countys real property tax is an ad valorem tax a tax according to value. LAS VEGAS Nevadas two-step property-tax assessment and billing system gives unsuspecting property owners no chance to contest their tax bills unless they carefully.

Nevadas effective property tax rate calculated as a percentage of. If you run a credible property tax lending company that offers flexible and low fixed rate property tax. 123 Main St.

Nevadas property tax rate is constitutionally limited to five percent of assessed value not market value.

Taxpayer Information Henderson Nv

Understanding Your Residential Bill

9511 Kings Gate Ct Las Vegas Nv 89145 Realtor Com Las Vegas Luxury Las Vegas Las Vegas Homes

Mesquitegroup Com Nevada Property Tax

24 Sawgrass Ct Las Vegas Nv 89113 Realtor Com Las Vegas Vegas Real Estate Professionals

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Taxpayer Information Henderson Nv

Mesquitegroup Com Nevada Property Tax

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Nevada Is The 9 State With The Lowest Property Taxes Stacker

Accounting Services Las Vegas Accounting Services Business Tax Small Business Tax

Home Closing Delayed In 2021 Selling House How To Plan What Happens If You

Developer Plans Apartment Tower Near Downtown Las Vegas Downtown Las Vegas Las Vegas Real Estate Las Vegas Boulevard

Mesquitegroup Com Nevada Property Tax

Mesquitegroup Com Nevada Property Tax

24 Sawgrass Ct Las Vegas Nv 89113 Realtor Com Las Vegas Vegas The Neighbourhood

What Is The Tax Impact Of A Short Sale Mortgage Payment Bank Owned Homes Homeowners Insurance

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv